Abstract

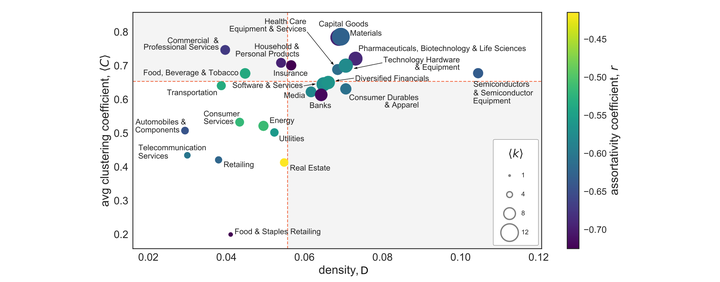

Globalisation continuously produces novel economic relationships mediated by flows of goods, services, capital, and information between countries. The activity of multinational corporations (MNCs) has become a primary driver of globalisation, shaping these relationships through vast networks of firms and their subsidiaries. Extensive empirical research has suggested that globalisation is not a singular process, and that variation in the intensity of international economic interactions can be captured by ‘multiple globalisations’, however how this differs across industry sectors has remained unclear. This paper analyses how sectoral variation in the ‘structural architecture’ of international economic relations can be understood using a combination of social network analysis (SNA) measures based on firm-subsidiary ownership linkages. Applying an approach that combines network-level measures (Density, Clustering, Degree, Assortativity) in ways yet to be explored in the spatial networks literature, a typology of four idealised international network structures is presented to allow for comparison between sectors. All sectoral networks were found to be disassortative, indicating that international networks based on intraorganisational ties are characterised by a core-periphery structure, with professional services sectors such as Banks and Insurance being the most hierarchically differentiated. Retail sector networks, including Food & Staples Retailing, are the least clustered while the two most clustered networks—Materials and Capital Goods—have also the highest average degree, evidence of their extensive globalisations. Our findings suggest that the multiple globalisations characterising international economic interactions can be better understood through the ‘structural architecture’ of sectoral variation, which result from the advantages conferred by cross-border activity within each.